Key Changes to Stamp Duty from April 2025

Currently, landlords and second-home buyers pay an additional 3% SDLT surcharge on top of standard rates when purchasing property in England and Northern Ireland. However, under the new tax system starting April 2025, the structure will become more progressive and costly for investors.

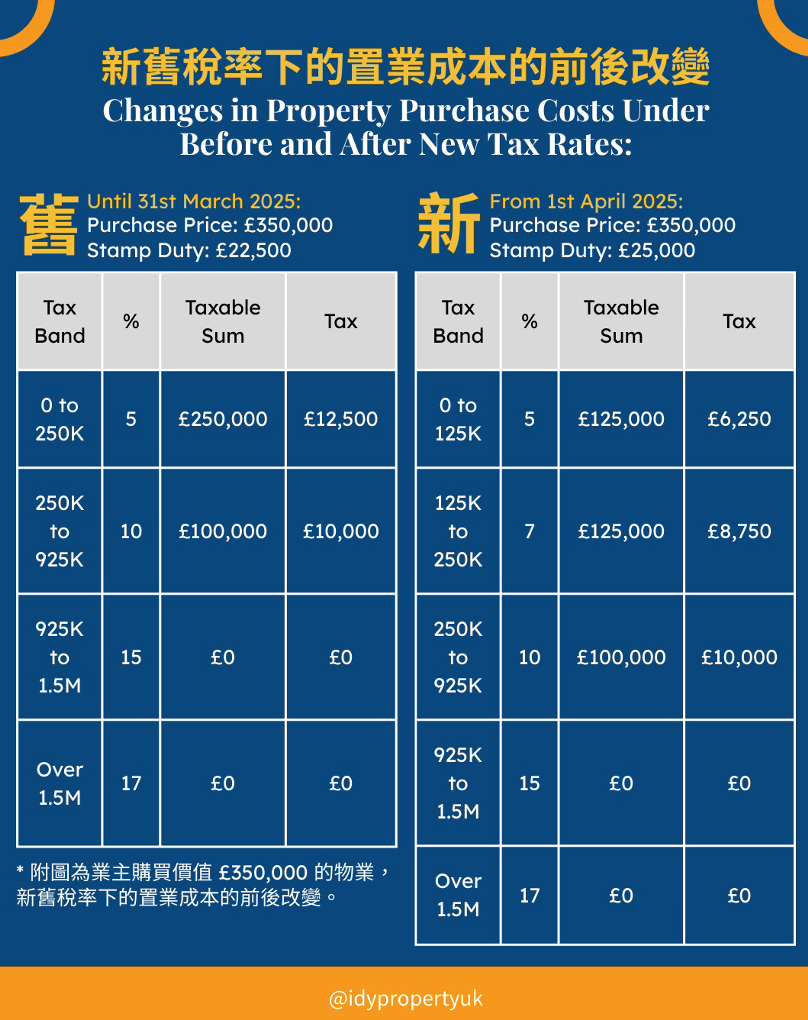

– Increased SDLT Rates for Additional Properties: The previous 3% surcharge will be replaced by a tiered system. The new rates will be:

– 5% on the portion of the property price up to £125,000

– 7% on the portion between £125,001 and £250,000

– 10% on the portion between £250,001 and £925,000

– 15%on the portion between £925,001 and £1.5 million

– 17%on any portion above £1.5 million

– Example of Tax Increase: Previously, a landlord purchasing a £350,000 property would pay £22,500 in SDLT.

Under the new structure:

– 5% on the first £125,000 = £6,250

– 7% on the next £125,000 = £8,750

– 10% on the remaining £100,000 = £10,000

– Total SDLT = £25,000

Changes in Property Purchase Costs Under Before and After New Tax Rates:

This considerable rise in SDLT may deter some investors from expanding their portfolios, making rental property investments less attractive.

Impact on Landlords and the Rental Market

The increased tax burden could lead to significant changes in the rental sector. Here’s what landlords and tenants should expect:

- Reduction in Buy-to-Let Investments

Many landlords may reconsider purchasing additional rental properties due to the higher tax costs. Industry experts predict a decline in buy-to-let acquisitions, which could tighten the supply of rental properties and increase competition among tenants.

- Increased Rents for Tenants

With fewer landlords entering the market and some selling off properties, rental supply is expected to dwindle. Given the already high demand for rental homes, reduced supply could push rental prices higher, making it even more difficult for tenants to find affordable housing.

- Landlords Exiting the Market

For landlords, rising costs are accelerating decisions to exit the market. Fifteen percent of landlords are selling properties due to higher taxes, including a surcharge on second homes and buy-to-let investments that will increase to 5% in 2025. This trend could worsen the rental housing shortage, which is already under pressure from surging tenant demand.

Other Financial Changes Affecting Landlords in April 2025

In addition to SDLT changes, landlords must also prepare for other financial adjustments coming into effect:

– Council Tax Increases for Second Homes: Over 500,000 second-home owners in England will see their council tax bills double, further increasing the costs of holding properties. This may encourage homeowner to sell.

– Energy Price Cap Adjustments: With adjustments to the energy price cap, landlords who provide utility-inclusive rental agreements will likely face increased costs, which could be passed on to tenants through higher rents.

– New Energy Efficiency Regulations: Stricter energy efficiency requirements for rental properties could impose additional upgrade costs on landlords. Non-compliance may result in fines or an inability to rent out properties.

What Landlords Can Do to Prepare

Given these changes, landlords should consider their long-term strategies. Some key steps include:

- Reviewing Portfolio Viability: Assess whether the increased SDLT and other costs make property investments profitable in the long run.

- Exploring Alternative Investment Locations: Some areas may offer better rental yields, offsetting higher SDLT costs.

- Adjusting Rental Prices: Landlords may need to adjust rents to compensate for higher tax burdens, while remaining competitive in the market.

- Seeking Professional Advice: Consulting tax experts and property advisors can help navigate these changes efficiently.

Conclusion

The April 2025 stamp duty changes represent a major shift for landlords and the rental market. While the government aims to curb speculative property purchases and ease housing affordability issues, these changes may also lead to reduced rental property availability and higher rents. Landlords and tenants alike must prepare for potential market fluctuations and financial adjustments in response to these new policies